A flurry of new desert solar projects is set to accelerate learnings in bifacial module technology.

In April, Saudi Arabia's ACWA Power signed an eye-wateringly low tariff of $17.0/MWh for a 900 MW solar plant in Dubai and said it would use bifacial panels and trackers. The $570 million project will increase the capacity of the Mohammed bin Rashid Al Maktoum Solar Park to 2.9 GW.

The 800 MW Al Kharsaah project in Qatar, the kingdom's first large-scale solar plant, will feature 2 million bifacial panels with trackers. The $500 million project is 60% owned by Qatar group Siraj and 40% owned by French oil group total and Japanese conglomerate Marubeni. The technology for Abu Dhabi's record-breaking 2 GW Al Dhafra Solar PV project, signed at a record-low tariff of $13.5/MWh, is yet to be confirmed. The development consortium reportedly includes Jinko Solar, a manufacturer of bifacial and monofacial technology.

In the US, Nevada’s ground-breaking 690 MW Gemini solar-plus-storage project will also reportedly use bifacial modules. Last month, project owner Quinbrook Infrastructure Partners received full federal approval for the project.

Early performance data shows that bifacial modules can offer double-digit performance gains over monofacial designs, depending on site conditions and plant layout.

In desert environments, bifacial panels can increase power output by as much as 35% when using special ground treatments that improve ground reflectance (albedo), Rajit Nanda, Chief Investment Officer at ACWA Power, told New Energy Update. ACWA Power develops projects across the Middle East, North Africa, Southern Africa and Southeast Asia.

Normal ground albedo in desert condition ranges between 30% and 45% and ground treatment using materials such as white sand, limestone or man-made materials, can increase this to 75%-80%, Nanda said.

Until now, investor confidence in bifacial modules has been curbed by a lack of operational data. This should soon change, as the large projects built in the Middle East and US provide a swathe of technology and modeling insights.

No downside

Ground reflectance is a crucial driver of bifacial performance, making the US and the Middle East key growth markets.

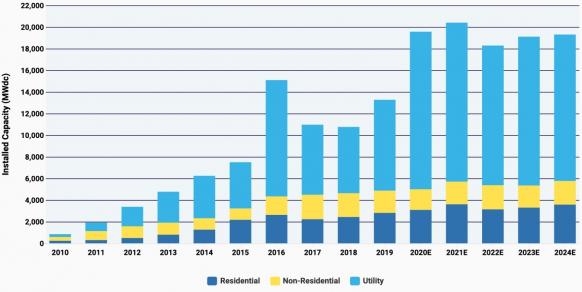

The US installed its first wave of large-scale bifacial projects last year. By 2025, around 30% of new U.S. utility-scale projects will use bifacial systems, according to the US National Renewable Energy Laboratory (NREL). By 2028, bifacial cells could represent 40% of the global solar market, according to the International Technology Roadmap for Photovoltaic (ITRPV).

Cedric Andre Broussillou, Research Director at the Qatar Environment and Energy Research Institute (QEERI), is more bullish.

“I estimate bifacial technology will go well above 50% of the global utility-scale market in the next few years,” he said.

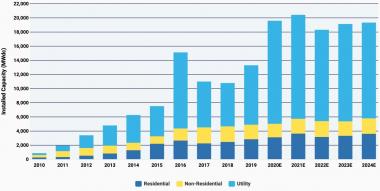

Forecast bifacial solar installations by region

(Click image to enlarge)

This chart was updated June 15 to show Wood Mackenzie's 'high adoption' forecast for bifacial panels (September 2019). Strong growth since the forecast means this is a "better representation of the market" than the base case, Wood Mackenzie said.

Source: Wood Mackenzie, September 2019

Early investments by European banks, including those by the European Bank for Reconstruction and Development in Egypt's Benban solar park, have helped to "de-risk the technology,” Broussillou said.

“They limited the risk by using conservative assumptions for the bifacial gain and accepted some additional cost to demonstrate that the technology can be trusted at large scale," he said.

From a construction and operation perspective, there is no downside to using bifacial panels, Nanda said.

“This is the same module with a back side which produces gain in generation...These modules are abundantly available and have the same level of redundancy in spares," he said.

Material gains

Proven long-term reliability of bifacial panels will be key to reducing investment risk.

While there is currently a limited track record for bifacial performance, the materials used, such as the glass used to replace plastic back sheets, are intrinsically as reliable as those on operational monofacial plants, Broussillou said.

Advances in PV cell design are also creating a wider range of bifacial supply options.

"All new cell technologies which are being developed (PERC+, PERT, TOPCon, HJT) can include a bifacial design with the grid pattern on the front and back thus making those cells compatible with a bifacial module packaging," he said.

Bifacial forecasts

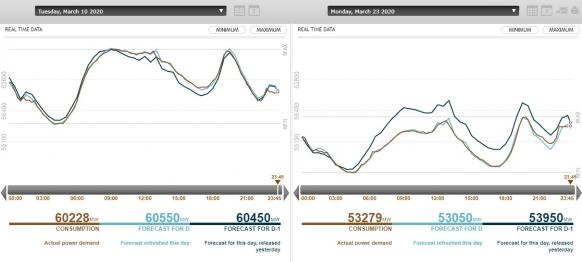

Improvements in bifacial modelling accuracy will also help to increase investor confidence, Veronica Bermudez Benito, Senior Research Director, Energy at QEERI, said.

QEERI is developing solar forecasting models based on multi-variate machine learning methods.

“The next step is to integrate this solar forecast capability into PV production forecasting integrating the specificities of the different PV technologies,” Bermudez said.

Forecasting is particularly important for the latest giant projects that have signed record low tariffs.

“You really need to optimize your predictions to keep the estimation errors low, as a way to optimize your return on investment,” Bermudez said.

Reporting by Ed Pearcey

Editing by Robin Sayles